Urbanization is a defining characteristic of the modern world, with cities becoming the central hubs of economic activity, innovation, and cultural exchange. As urban areas continue to expand, the financial dynamics within these cities also evolve, giving rise to the concept of "urban money." This term encompasses the unique financial systems, practices, and challenges that are inherent in densely populated urban environments. This article explores the concept of urban money, its implications for city dwellers, and the innovative financial solutions emerging to meet the needs of urban populations.

The Nature of Urban Money

Urban Money refers to the financial activities and transactions that take place within cities, driven by the dense concentration of people, businesses, and institutions. The financial landscape of urban areas is characterized by a high volume of transactions, diverse economic activities, and the need for efficient and scalable financial solutions. Key aspects of urban money include:

Digital Payments: Cities are at the forefront of the digital payment revolution. With the widespread use of smartphones and the internet, digital wallets, mobile banking, and contactless payments have become the norm. This shift towards digital transactions enhances convenience, security, and traceability of financial activities.

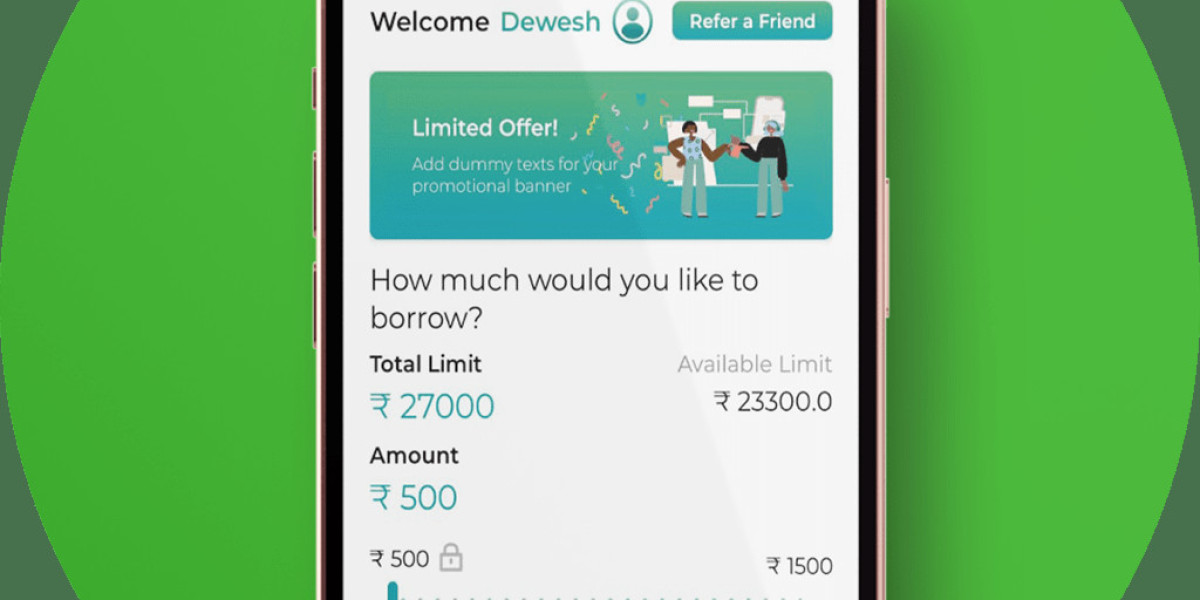

Gig Economy and Freelancing: Urban areas often have a thriving gig economy, with many individuals working as freelancers or in short-term, flexible jobs. This requires financial services that cater to the unique needs of gig workers, such as quick access to earnings, low-fee banking solutions, and micro-loans.

Microfinance and Peer-to-Peer Lending: The financial inclusivity of urban populations is a critical concern. Microfinance institutions and peer-to-peer lending platforms play a vital role in providing credit and financial services to underserved communities, enabling entrepreneurship and economic participation.

Real Estate and Property Finance: The high demand for housing and commercial space in cities leads to complex real estate markets. Urban money includes significant investments in property development, mortgage financing, and real estate transactions, requiring robust financial mechanisms to support these activities.

Financial Challenges in Urban Areas

Income Inequality: Urban areas often exhibit stark income disparities. While cities generate significant wealth, this prosperity is not always evenly distributed. Financial solutions must address the needs of both affluent individuals and low-income residents to promote equitable economic growth.

Cost of Living: The cost of living in cities is typically higher than in rural areas, impacting the financial well-being of residents. Affordable housing, transportation, and essential services are crucial for maintaining a balanced urban economy.

Access to Financial Services: Despite the concentration of financial institutions in cities, not all residents have equal access to banking and credit facilities. Financial inclusion initiatives are necessary to ensure that everyone can participate in the urban economy.

Innovative Financial Solutions for Urban Populations

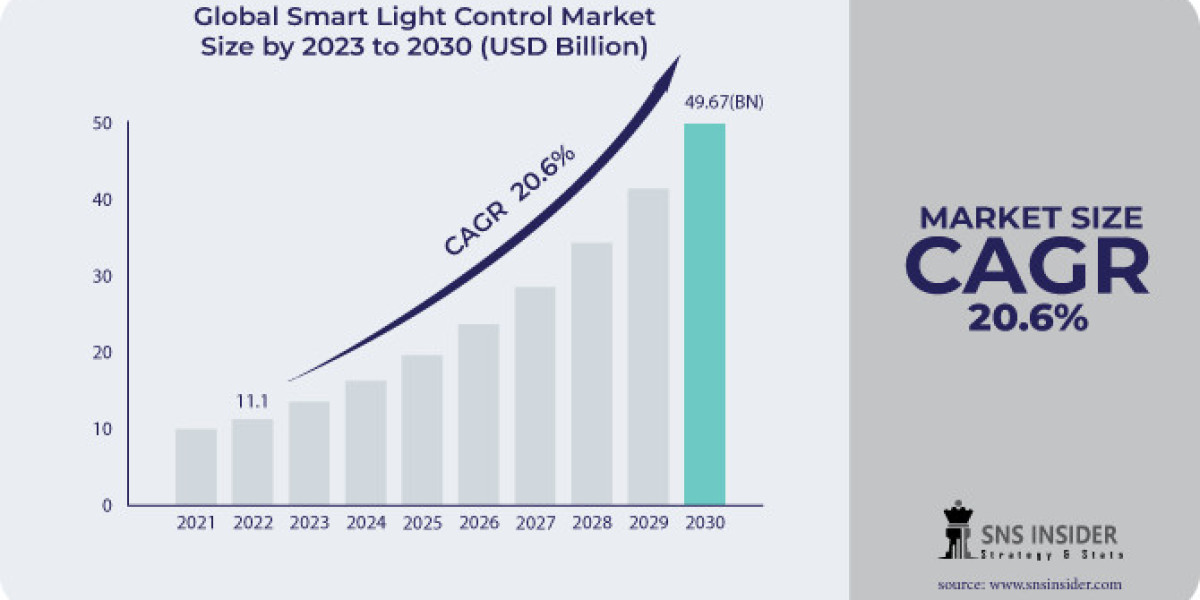

Smart City Technologies: The integration of smart technologies in urban infrastructure can revolutionize financial services. From blockchain-based property records to AI-driven financial planning tools, smart city initiatives enhance the efficiency, transparency, and accessibility of urban money.

Digital Banking and Fintech: Fintech companies are at the forefront of transforming urban finance. Digital banks, peer-to-peer payment platforms, and robo-advisors offer personalized, convenient, and low-cost financial services tailored to the urban lifestyle.

Sustainable Finance: As cities aim to become more sustainable, financial instruments such as green bonds and impact investments support eco-friendly projects. These initiatives finance renewable energy, sustainable transportation, and green infrastructure, contributing to a healthier urban environment.

Community-Based Financial Models: Cooperatives, credit unions, and community development financial institutions (CDFIs) provide localized financial services that address specific urban needs. These models foster community engagement and economic resilience.

Conclusion

Urban money encapsulates the diverse and dynamic financial activities within cities, influenced by the density and diversity of urban populations. As cities continue to grow and evolve, so too must the financial solutions that support them. By embracing digital innovation, promoting financial inclusion, and addressing the unique challenges of urban living, we can create a robust and equitable financial landscape that empowers all city dwellers. The future of urban money lies in the intersection of technology, sustainability, and community, paving the way for vibrant and resilient urban economies.

For more info. visit us: